Entrepreneurship: The Runway

I’ve been having a lot of entrepreneurship conversations lately with clients, friends, and former classmates. These are fun conversations, and often we go through the same value discovery and alignment conversations discussed in previous newsletters. It’s amazing what can be uncovered by pulling on threads a bit and really examining how a business idea aligns with our ideal life.

There’s a business out there that aligns with your values and priorities, but it might not be obvious until you’ve gotten crystal clear on what your ideal life looks like.

Before we dive into this week’s topic, here are three things I read this week that I thought you’d like

WSJ – The Fed Made Its Move. Why Didn’t I?

Another great article by Jason Zweig highlighting how investors often miss the implementation step between moving money into an account and actually investing it. In 2022, more than half of direct contributions to Vanguard IRAs sat in cash for more than 12 months.

WSJ – A Tax-Shelter Crackdown Uncovers a Dentist’s “Smile High Trust”

“People see a complex structure and think, this is what rich people do to reduce their taxes.” You might not know the difference between solid tax planning (tax avoidance = legal) and sketchy tax dodging (tax evasion = illegal). The IRS does not care about your ignorance, don’t try to “outsmart the system.”

Smart with a Heart – GRE Prep Discount for Sitreps2Steercos

You know how important standardized tests are for MBA admissions. This nonprofit is helping level the playing field for Veterans seeking enrollment at top MBA programs. Worth a share for your peers a year or two out from the admissions cycle.

Let’s dive in!

This month’s topic is ENTREPRENEURSHIP. There are many ways you can be an entrepreneur and many reasons why people choose this route. We will focus on the traditional route, building a company from scratch. Over the next month we will cover:

• Runway

• Idea

• Execution

• Exit

Building a company from the ground up might not be the most popular way to build wealth as a recent MBA graduate, but it’s the one I know and you’re spoiled for educational choices if you’re interested in the Search Fund route.

The Runway.

Maybe a third of Veterans with MBAs that I meet bring up starting their own business. Common motivations I hear include: making societal change, financial independence, being their own boss, or serving a community.

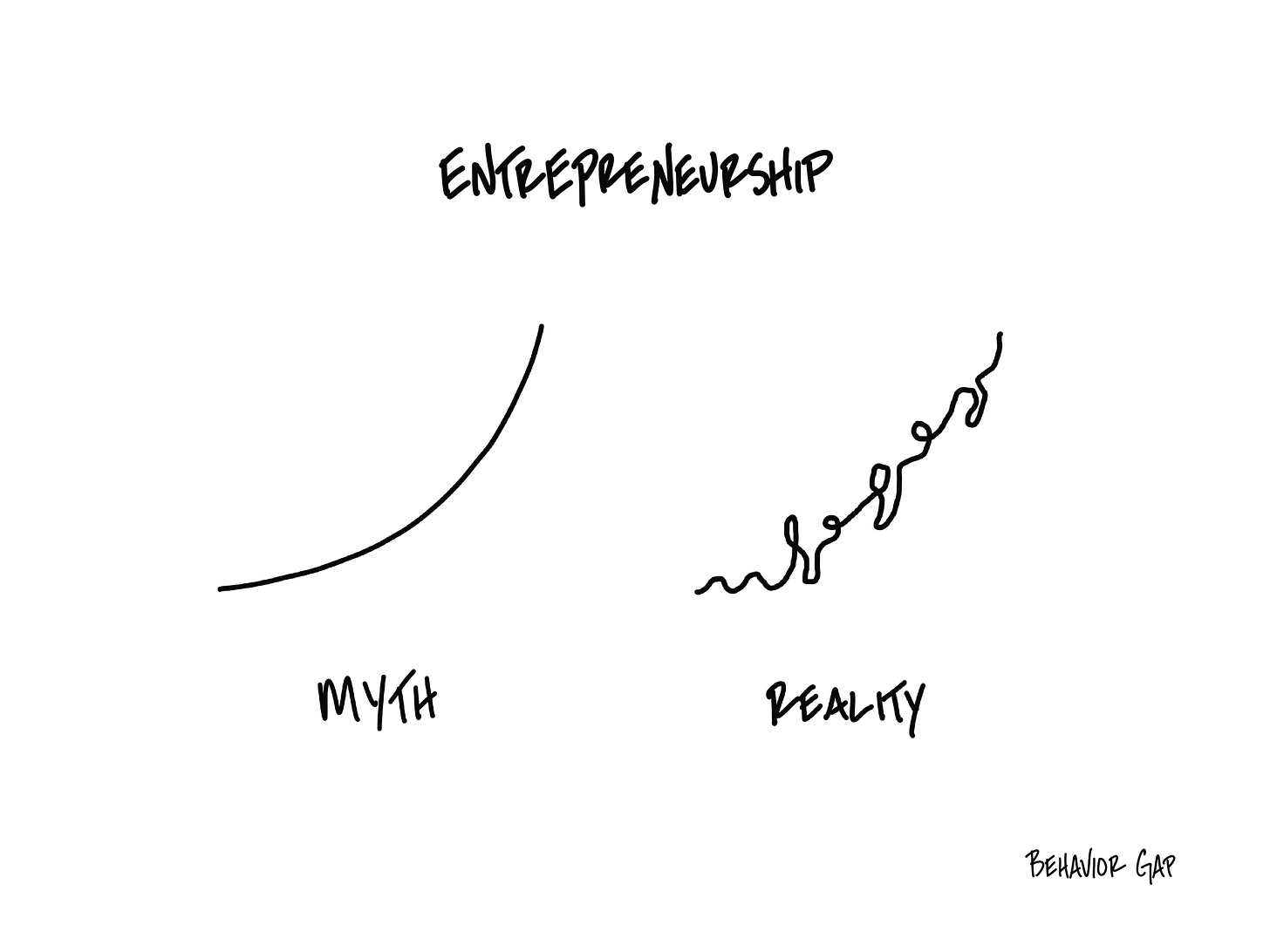

Whatever your motivation, there is a hard truth involved with starting a business. Time and money are finite resources, and allocating either towards starting a business involves an opportunity cost.

There’s nothing wrong with starting a side business, and sometimes those can be the best of both worlds. Some examples include Sitreps2Steercos, The Veteran Professional, and everyone reading this who owns a rental property.

Personal Finance.

Unless you are starting the business on the side while still fully employed, you will be forgoing income while your business gets off the ground.

Even if your spouse is gainfully employed, you will likely have living expenses that exceed your household income during the startup phase of your business.

That’s ok if you have planned for it.

Although this plan focuses on money, the most significant factor for many will be the time required to build up these reserves. This doesn’t happen overnight, and the time to start building those reserves out isn’t two months before launch.

It doesn’t matter how good your business plan is, if your family’s cash reserves run out before the business can become successful, the business is more likely to fail.

Failure here is pretty broad, so I’ll define it as deviating from the path that best supports your long-term success. Maybe this means taking on clients who are not a good fit, taking on projects that distract from your core business, partnering with individuals or firms who do not align with your vision, or simply having to close shop permanently.

So if you have an itch, an idea that you might want to start a business in next year or two, start building out your own financial runway now. The worst that happens is you have some opportunity cost associated with losing out on potential stock market returns while some extra cash sits in a high yield savings account or a short-term bond ladder. The best that happens is that when the right opportunity arises, you can strike.

Benchmarking.

Understanding your personal expenses is pretty simple. Your living expenses roughly equal your gross pay – taxes – retirement/investment savings. Yes, you can live leaner if you need to, but that number is the status quo.

Understanding your business’ cash flows are a bit more challenging.

Mainly because your business doesn’t yet exist.

Here’s where a detailed business plan and benchmarking come in.

I’m going to assume that since you have an MBA from an amazing program, are a hard worker, and are reasonably risk averse, that you have a well thought out business plan in hand before you quit your day job and pursue your dream. Hopefully the business plan has gone through multiple evolutions as your trusted advisors and mentors have poked holes in it (i.e. torn it apart to make it better). As part of this business plan, you will likely include a pro-forma income statement for the next few years.

The more established the sector and more focused your business, the narrower your projections can likely be. Ideally, you can access trade publications that detail startup costs, expected cash flows, and expected compensation structures.

You’re thinking, “no F-ing way this report exists”

It did for my industry. I knew the average growth curve for independent Fee-Only RIAs, projected my costs for the next three years, and determined the necessary financial runway to launch my firm while staying true to my ideals.

Was everything in one place? No

Was everything perfect? No

Will everything go exactly as planned? No

And that's okay! The goal isn't a perfect plan but a quality plan based on simplicity and flexibility. Oh, and one more thing…..

Conservative Estimates.

I’d rather underestimate my revenue and overestimate my costs than the opposite. Based on my business plan, I have a solid estimate of where my costs and revenues will be three years into my business.

And I know my projections are conservative.

When I meet other founders who started businesses with a similar business model I hear, “Oh yeah, you’re going to blow those numbers out of the water.”

And I’m ok with that.

My financial runway is also conservative. I took the conservative numbers from my pro-forma income statement and then made them even more conservative for my personal financial runway.

Why?

So I can keep true to my ideals, say no to bad business, and remain focused on what makes my business unique rather than being distracted serving clients who aren’t an amazing fit.

Plus it reduced the stress my wife had about me forsaking a traditional post-MBA finance career to pursue my dream career instead.

Now, there are some limits to putting conservative estimates in place and you must keep opportunity costs in mind. For my family’s financial plan, these assumptions made sense. Your financial plan might look very different because it’s tailored to your unique situation.

Bringing it back.

Your runway will have many inputs. It will be unique to your family, the business you are starting, and your own finances.

Start build this runway before you need it. The more proactive you are, the more flexibility you’ll have when opportunities arise. A well-build financial runway allows you to focus on your business without adding unnecessary financial stress to your family.

On the business front, this quarter we are focusing on year end activities. These include final Tax Projections, Roth Conversions, and final Tax Gain/Loss Harvesting. For clients who filed an extension, your tax returns are due 15 October and you will be receiving an email reminder to upload a copy of your 2024 tax returns to Dropbox.

Hope you have a great week.

-Henry